DATE : MARCH 3, 2018

RESULT: 5-7-28-39-47-54

RESULT: 5-7-28-39-47-54

6/42 NO WINNER

DATE : MARCH 3, 2018

RESULT: 8-19-24-30-35-39

6/58

RESULT: 8-19-24-30-35-39

6/58

Draw Date 3/4/18

Estimated Jackpot Prize P50M

6/49

Draw Date 3/4/18

Estimated Jackpot Prize P58M

6/55

Draw Date 3/5/18

Estimated Jackpot Prize P30M

6/45

Draw Date 3/5/18

Estimated Jackpot Prize P38M

6/42

Draw Date 3/6/18

Estimated Jackpot Prize P27M

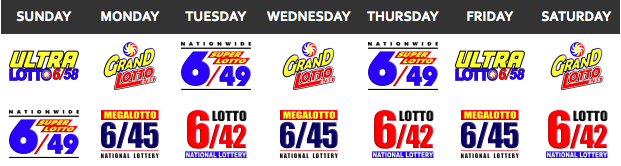

The Philippine Charity Sweepstakes Office is asking the Bureau of Internal Revenue to help them justify to the public the 20 percent in taxes imposed on lottery winnings worth P10,000 or more starting this year, as stipulated under the new Tax Reform for Acceleration and Inclusion or TRAIN Law.

PCSO general manager Alexander Balutan on Monday said the agency will invite BIR experts to explain the law for the benefit of the gaming public, as taxes on lottery winnings began last month.

“At first, [the tax] was just 10 percent. We haven’t really explained the tax here. We are inviting experts from the BIR on how we will justify the taxes,” Balutan said.

On Friday, two lucky bettors won and shared the whopping P332-million jackpot in the PCSO’s Ultra Lotto 6/58 draw. The winnings are now subject to the new tax law.

“We cannot do anything, that is now the law. The problem is, the betting public might be dissuaded from playing. But according to our lawmakers, that’s still a windfall. If you win P100 million and have to give back P20 million to the government, you’d still be happy with it,” Balutan said.

While the PCSO is still awaiting the betting public’s reaction to the new tax law, Balutan said the important thing is that the taxes will automatically go to the charity fund, which will be given out to the needy.

Source: Manila Standard

Remember:

Collecting more Taxes is a legalized robbery.

Source: Manila Standard

Remember:

Collecting more Taxes is a legalized robbery.